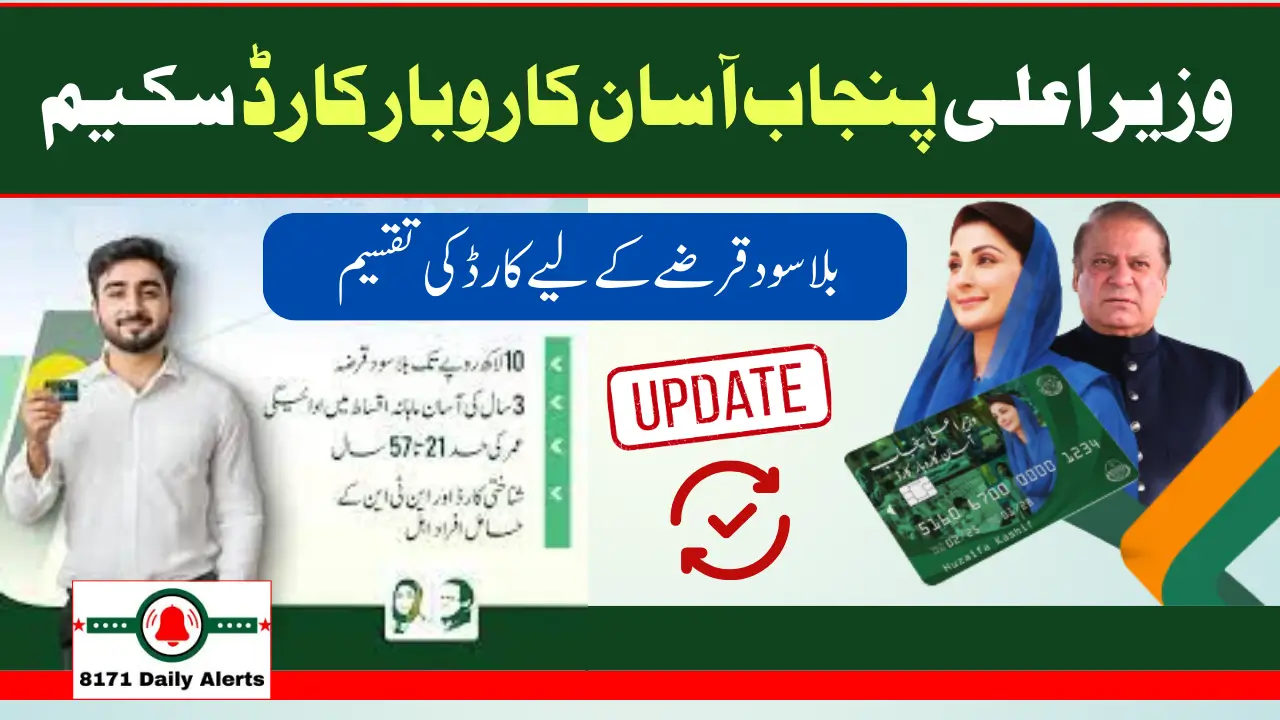

The Punjab Government has officially started the distribution of the Asaan Karobar Card on the date of today. The aim of this scheme is to make it possible for small businesses to obtain interest-free loans, also this will enable them to grow and be stable by availing structured and transparent financial assistance.

The process of distributing cards has started among all the small businesses that have completed their registration process. The process of Punjab Asaan Karobar Card Distribution has been started by Ms. Maryam Nawaz. In this article, you will be told how you can check your eligibility and know whether you have been able to get the card or not. Apart from this, you will be fully informed about all the advantages and disadvantages of the card.

Key Features of the Asaan Karobar Card Card

The Asaan Karobar Card comes with many financial perks for small business owners:

- Maximum Loan Limit: Up to PKR 1 million

- Loan Duration: 3 years

- Loan Type: Revolving credit facility for 12 months

- Repayment Term: 24 equal monthly installments after the first year

- Grace Period: 3 months are given to the borrowers before the repayment process starts

Asaan Karobar Card program has made it possible for entrepreneurs to invest more in their businesses while avoiding the exorbitant interest charges that a bank loan usually carries.

Good News! Nigehban Program Online Registration Through PSER Portal Registration 2025

Asaan Karobar Card Loan Utilization Details

The CM Punjab Asaan Karobar Card funds, which are the proceeds received, are only used in business operations, which may include the following:

- Payments to vendors and suppliers

- Payment of utility bills, government fees, and taxes

- Cash withdrawal (up to 25% of the limit) for essential business purposes

- Digital transactions via POS and mobile applications

This is a guarantee that the funds received will be utilized in the growth and efficiency of the business only.

Eligibility Criteria

To take advantage of the Asaan Karobar Card, they should fulfill the following conditions by providing the following documents:

- Must be a small business owner operating in Punjab

- Age must be between 21 to 57 years

- Must be a Pakistani citizen and resident of Punjab

- Should possess a valid CNIC and a registered mobile number

- Must have an existing business or plan to start one in Punjab

- Should have a satisfactory credit history with no overdue loans

- Only one application per individual or business is allowed

This kind of eligibility guarantees that the realized small business owners will gain access to the financial support they deserve.

Punjab Nigehban Ramzan Package Latest Date To Apply 20 February 2025

Loan Repayment and Usage Terms

The first 50% of the Loan Limit: That can be used within the first 6 months it has been made available

- Grace Period: 3 months before installment payments begin

- Repayment Schedule: Borrowers have to pay 5% of the remaining loan balance (excluding the principal amount) every month after the grace period.

- The second 50% of the Loan Limit: Once you have efficiently used the first 50%, you will get the rest of the loan amount regularly topped up by repayments and you have been requested to register with the PRA/FBR

- Restricted Transactions: Anything that is not qualified as a business expense (such as personal expenses, entertainment) is not allowed

- Final Repayment: The remaining balance after the 1st year is repaid in 2 years and the installments are of the same amount for every month

In the context of entrepreneurs’ financing, the structured terms for the repayment are conducive to steady and manageable loan redemption.

Key Conditions Of Karobar Card

Loan funds which need to be the business’s core activities are spent on. If less than six months are left in the card’s validity period and the business is expected to pay taxes, it should be registered by then. For each business or a single person, only one application can be submitted. These conditions will check the misuse of the scheme and can also provide fair access to funding.

Asaan Karobar Finance Scheme Interest Free Loans for SMEs of Punjab Latest 2025

Asaan Karobar Card Distribution Latest Update

The Punjab Government has recently informed that the first batch of loan approvals have been successfully processed and deserving entrepreneurs have started getting their Asaan Karobar Cards. Apart from that, the new mechanism of electronic transactions will be brought to make the process of payment of business partners more efficient and safer.

The government also plans to expand the loan limit for businesses with high performance that can repay it promptly. These adjustments are aimed at continuously improving the scheme and providing better support for small business owners.

For More Information: Punjab Asaan Karobar Card Loan Scheme Online Apply Latest Date

Conclusion

The CM Punjab Asaan Karobar Card is a groundbreaking initiative aimed at empowering small business owners by providing them with easy access to interest-free loans. With structured repayment plans, strict eligibility criteria, and digital transaction facilities, the scheme ensures that financial support is utilized for business growth.

The latest updates further reinforce the government’s commitment to strengthening the SME sector and driving economic prosperity in Punjab. Entrepreneurs are encouraged to take advantage of this opportunity and contribute to the region’s economic development.