Asaan Karobar Loan Scheme 2025

Asaan Karobar Finance Scheme is a financial relief program aimed at helping small and medium-sized businesses. Government of Punjab provides loans through a digital SME card that can be used for various business-related expenses. Chief Punjab Minister Maryam Nawaz revolutionary initiative to uplift small businesses the Asaan Karobar Loan Scheme 2025. Through this scheme, interest-free loans of up to PKR 1 million are being offered to small entrepreneurs across Punjab.

This article explains everything about the cm punjab loan scheme 2025 online apply, how to use the PITB portal, the benefits of the Asaan Karobar Card, and step-by-step guidance on the asaan karobar finance scheme 2025 online apply process. This is especially useful for people living in rural or small towns who want to start or grow their business without paying any interest.

Key Features of Asaan Karobar Finance Scheme

Below is a quick summary of the main features of the Asaan Karobar Finance Scheme Apply Online:

| Feature | Details |

|---|---|

| Maximum Loan Amount | PKR 1,000,000 |

| Loan Tenure | 3 Years |

| Grace Period | 3 Months |

| First Year | Revolving credit facility |

| Next 2 Years | Monthly installments |

| Cash Withdrawal Limit | 25% of total loan |

| Interest Rate | 0% (Interest-Free) |

| Usage | Business transactions, bills, government fees |

| Transaction Mode | Digital via App & POS machines |

Punjab Apni Chat Apna Ghar 1500000 Loan Distribution Ceremony

Eligibility Criteria

To apply for the Asaan Karobar Finance Scheme, you must meet the following conditions:

- Age between 21 and 57 years

- Must be a Pakistani national residing in Punjab

- Must have a valid CNIC

- Own an existing or proposed business in Punjab

- Have a registered mobile number

- Maintain a clean credit history

- Pass credit and psychometric assessments

- One application per person or business

Good News! Punjab Karobar Card Scheme For Free Interest Loan (0.1 to 10 Million)

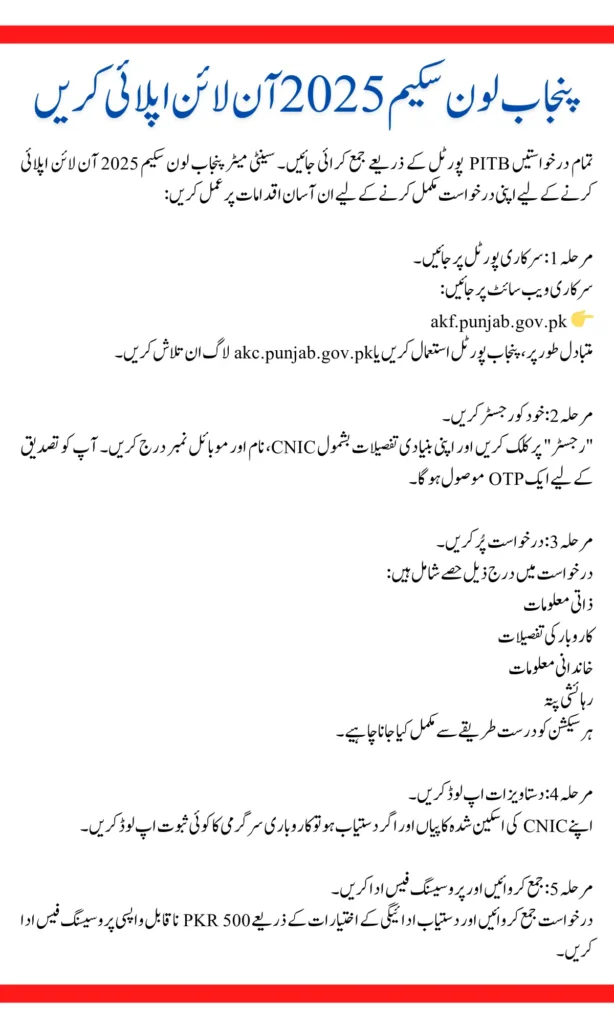

Punjab Loan Scheme 2025 Apply Online

All applications must be submitted through the PITB Portal. Follow these simple steps to complete your application for cm punjab loan scheme 2025 online apply:

Step 1: Visit the Official Portal

Go to the official website:

👉 akf.punjab.gov.pk

Alternatively, use the Punjab Portal or search for akc.punjab.gov.pk login.

Step 2: Register Yourself

Click on “Register” and enter your basic details including CNIC, name, and mobile number. You will receive an OTP for verification.

Step 3: Fill Out the Application

The application includes the following sections:

- Personal Information

- Business Details

- Family Information

- Residential Address

Each section must be completed accurately.

Step 4: Upload Documents

Upload scanned copies of your CNIC and any proof of business activity if available.

Step 5: Submit and Pay Processing Fee

Submit the application and pay the PKR 500 non-refundable processing fee through the available payment options.

Government Of Punjab 8070 Kisan Card Get an Interest-Fee Loan of 150000

Loan Usage and Repayment Details

Here is how the loan facility works after approval:

- Only 50% of the loan amount is accessible in the first 6 months

- After a 3-month grace period, repayments begin in monthly installments

- Transactions are restricted to business-related activities

- Digital payment only via mobile apps and POS machines

- Cash withdrawal is allowed only up to 25% of the total loan

Asaan Karobar Loan Scheme 2025 Latest Update

As of April 2025, the registration process is still open through the official portal. There is no specific day allocated for registration, which means you can apply anytime by visiting the akf.punjab.gov.pk login page.

Once you apply, your application goes through a digital verification process. If approved, you will receive a confirmation call within 15 to 20 days. The call will either approve or reject your application with proper reasons.

If your application is successful, the first loan installment of PKR 300,000 will be issued within three months. After that, you will get a grace period of three months to invest the money. Phase two of the scheme will provide additional funding for growing your business further.

You May Love To Read: Punjab Asaan Karobar Card Loan Scheme Online Apply

Conclusion

The Maryam Nawaz Asaan Karobar Loan Scheme 2025 is a life-changing opportunity for small entrepreneurs across Punjab. Whether you’re running a small shop, home business, or launching a new idea, this scheme provides interest-free funding and full digital support to help you grow.

With easy application steps via PITB Portal, secure transactions using the Asaan Karobar Card, and the support of CM Punjab Loan Scheme Apply Online Login, now is the time to take your business forward.

Frequently Asked Questions (FAQs)

1. Can I apply if I don’t have a running business?

Yes, the scheme is open for proposed businesses too, but you must have a solid plan.

2. What happens if I miss a payment?

You may be disqualified from future schemes and could be blacklisted.

3. Is this loan available for women entrepreneurs?

Yes, women are especially encouraged to apply under this scheme.

4. Can I withdraw the full amount in cash?

No, only 25% of the loan can be withdrawn in cash. The rest must be spent digitally.

5. How long will it take to get the loan after approval?

The first installment is issued within 3 months after approval.